– Led by its non-oil sector, Bahrain has achieved strong economic momentum with forecasts suggesting this will continue into 2018 with a brighter outlook across the GCC –

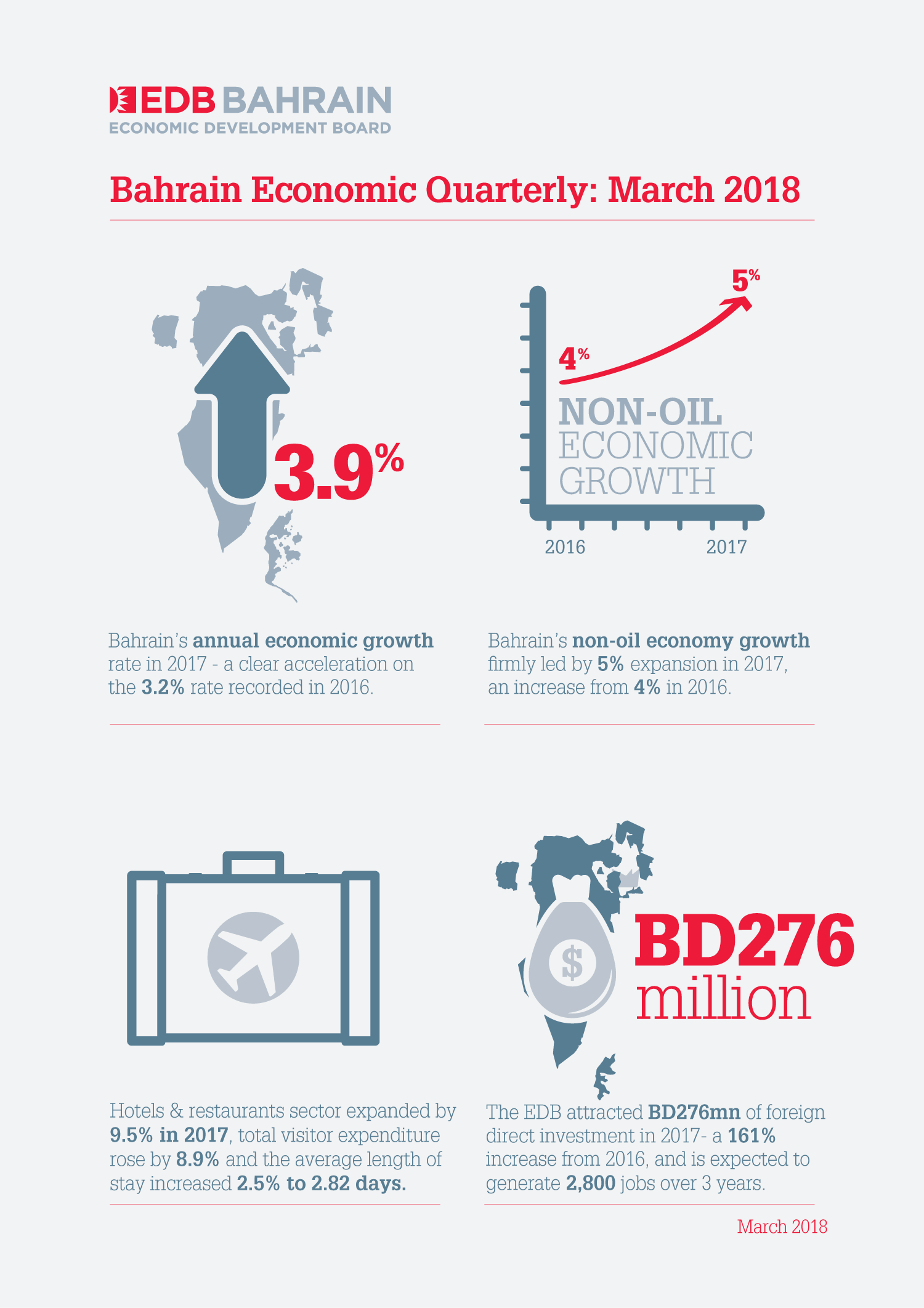

Manama, 2 May 2018: Data published in the latest Bahrain Economic Quarterly (BEQ) reveals that Bahrain’s real GDP grew by 3.9% in 2017, with the non-oil economy expanding by 5%, making it the fastest growing country in the GCC.

According to the quarterly report produced by the Bahrain Economic Development Board (EDB), the pace of growth in the Kingdom ‘accelerated markedly’ in 2017 compared to 3.2% in 2016. This strong performance in the face of sluggish regional growth was driven by broad-based success across the highly-diversified non-oil private sector, led by tourism, a strong pipeline of infrastructure projects, and a record year for foreign direct investment (FDI).

Earlier this month, the IMF’s World Economic Outlook forecast that Bahrain’s economy would continue to be the fastest growing economy in the GCC in 2018, suggesting momentum is expecting to be maintained into the current year.

Regionally, the BEQ predicts a significantly brighter outlook for the GCC in 2018, with a pronounced pick-up expected as economic diversification and fiscal consolidation efforts transition to their next phase and create a broad revenue base across the non-oil economy. The region’s future outlook will be at the heart of the upcoming investor forum, Gateway Gulf, which will bring together investors and business leaders from around the world in Bahrain on 8-10 May to unlock growth opportunities across the GCC.

Speaking on the publication of the BEQ, Dr Jarmo Kotilaine, Chief Economist, Bahrain EDB, commented: “Bahrain’s economic resilience aligns with broader regional and global trends in which we see more diversified economies tending to achieve faster growth. Region-wide, business confidence and growth momentum are set to benefit from a more benign outlook in the oil sector and we expect 2018 to mark an important milestone as the GCC’s makes the economic paradigm shift towards diversified private-sector led growth economies”.

Growth in Bahrain is being driven by a variety of strongly performing industries, led by tourism with the hotels and restaurants sector expanding by 9.5% in 2017, total visitor expenditure rising by 8.9% and the average length of stay increasing 2.5% to 2.82 days, in line with the government’s strategy to boost the sector and encourage longer stays from existing visitors. Other high performing sectors in 2017 included social and personal services (9.4%), led by private education and healthcare, trade (8.5%), real estate and professional services (5.5%) and financial services (5%). Additionally, the EDB attracted BHD 276 million of foreign direct investment into Bahrain in 2017, a record year for the organization. This represents an increase of 161% from 2016, and is expected to generate 2,800 jobs over the next three years.

The success of private sector industries across the Bahraini ecosystem supports the widespread recognition the Kingdom enjoys as a regional pioneer of economic diversification thanks to sustained efforts to improve the business and regulatory environment. This process continued apace in 2017, with data suggesting the oil and gas sector now accounts for only 18.4% of Bahrain’s real GDP, compared to 43.6% in 2000.

Despite the demonstrable success of economic diversification, oil and gas remains a strong component of Bahrain’s economy, with the Kingdom’s oil sector set to transition to an era of renewed growth. Therefore, the recent announcement that Bahrain has discovered its largest oil and natural gas repository since it began producing in 1932, is a significant boost to its future economic outlook. The 2,000 sq km Khalij al Bahrain field, which is expected to start production within the coming five years, is mainly composed of shale oil and natural gas in quantities that far exceed Bahrain’s current reserves, with a recent resource evaluation suggesting levels capable of supporting the long-term extraction of oil and gas.

Building on Bahrain’s strong economic platform highlighted by the latest BEQ figures, the EDB will bring together regional and global government, business and investment leaders next week at the first Gateway Gulf investor forum, hosted in Manama, Bahrain on 8-10 May. The exclusive invitation-only forum will deep-dive into growth opportunities across the GCC and showcase new investment-ready project across diverse industries including tourism, manufacturing, real estate, transport, energy, water and power.

– ENDS –

Notes to editor

Further information:

Telephone: 17589966

Email: Isa.mubarak@bahrainedb.com

About the Bahrain Economic Development Board

The Bahrain Economic Development Board (EDB) is an investment promotion agency with overall responsibility for attracting investment into the Kingdom and supporting initiatives that enhance the investment climate.

The EDB works with the government and both current and prospective investors to ensure that Bahrain’s investment climate is attractive, to communicate the key strengths, and to identify where opportunities exist for further economic growth through investment.

The EDB focuses on several economic sectors that capitalise on Bahrain’s competitive advantages. These sectors include financial services, manufacturing, ICT, tourism, logistics and transport.

For more information on the Bahrain EDB visit www.bahrainedb.com; for information about Bahrain visit www.bahrain.com.

About Gateway Gulf

Gateway Gulf is a major new investment event that will convene global industry leaders in order to unlock the opportunities being created by the economic transformation in the GCC.

The invitation-only event, held under the patronage of His Royal Highness Prince Salman bin Hamad Al Khalifa, Crown Prince, Deputy Supreme Commander and Chairman of the Bahrain Economic Development Board, will bring together 500 global investors and CEOs at the Four Seasons hotel, Manama from 8-10 May 2018.

Gateway Gulf will include both high-level plenary sessions and showcase investment-ready projects from across the region in sectors including oil and gas, real estate, tourism, housing, power, water, transport, public works and manufacturing.