From mobile wallets and payment apps that allow us to transfer money digitally at the push of a button, to stock-trading apps that make it possible to invest in and trade stock without visiting a stockbroker, fintech is a disruptive innovation in financial services. And it’s one that the world is embracing wholeheartedly.

While the term “disruption” may carry with it certain negative connotations, the reality is that, when it comes to financial services, a little shakeup can be a very good thing. Today, there is a growing demand for new advances in financial technology. As such, fintech startups are poised to reshape the future of finance. In fact, the global fintech market is expected to reach USD 309.98 billion at a CAGR Of 24.8% through 2022, up from USD 127.66 billion in 2018.

Here, we take a closer look at how fintech is changing the financial landscape, and how younger fintech companies can work with Bahrain to gain a competitive advantage.

Fintech: Disruption in Financial Services

Possibly the most disruptive innovation of the last 100 years is the rise of accessible digital communication technologies. And just as the advent of the internet caused a fundamental shift in how most of the world interacts, fintech advances are in the process of realigning focus and priorities for organisations around the globe.

It’s common to think of banks when one discusses financial technology. But banking is only one field that is seeing staggering advancements thanks to fintech. The most widely-impacted industries include the following:

- Banking

- Loans

- Personal finance

- Insurance

- Wealth management

- Venture capital

Throughout these and other industries, fintech provides undeniable customer advantages. By improving accessibility via mobile and cloud options, financial and insurance application-approval processes become more streamlined and gain a faster turn-around time.

At the same time, improved financial analytics and data collection allow organisations to create more personalised customer experiences and to better anticipate customer needs. Fintech security technologies such as encryption and biometrics are offering better protection for sensitive customer and organisational data. And through it all, the switch to financial technologies is eliminating the need for many now-redundant costs, allowing for reduced operational spending and better customer experiences.

The Future of Fintech

Up-and-coming fintech businesses have an advantage over many more-established financial institutions. Where century-old banks often rely upon entrenched mindsets, ingrained procedures, and legacy technologies, new players in financial services can start from a clean slate, incorporating state-of-the-art technologies into their core services from day one. Fintechs are embracing revolutionary new advancements in the fields of AI, machine learning, and big data, creating a future in which predictive intelligence allows for leaner business practices, and an unmatched customer experience.

While digital disruption is changing the entire financial services landscape, it’s important to recognise that fintech itself is anything other than a longshot. For one thing, fintech has grown significantly, now accounting for 35% of the financial services value chain. At the same time, the line between fintechs and banks is becoming increasingly blurred. Many fintechs focus on creating add-on products to partner with and supplement banking services; others move beyond single services to evolve into actual licensed banks. And in some cases traditional banks absorb smaller fintechs to improve and modernize their existing services.

This disruption of the status quo is one that stands to vastly improve processes within the financial sector. This is especially true in the following ways:

Improved Value

Fintechs enjoy improved flexibility. They are able to cut out unnecessary costs and do more with less. As such, they are able to create lean business operations, passing on potentially significant savings to their customers.

Engaging Branding

Financial services are essential, but are seldom the kind of thing that customers get really excited about. Independent fintechs have the freedom to take a new approach to branding, incorporating gamification and other personal approaches designed to turn traditionally boring financial tasks into something enjoyable.

Better Service

Fintech’s focus on single, specific services allows them to continually refine the customer experience. They build trust by targeting and resolving specific problems, and always help ensure that customer satisfaction is the primary goal.

The growth of fintech throughout the financial services industry affords real advantages to new fintech startups and scaleups attempting to gain a foothold. In fact, the fintech market share across 48 key fintech startups is currently worth more than USD 187 billion.

However, in order to thrive, these young fintechs need a friendly location in which to grow. This is why so many successful fintech companies are getting started in Bahrain.

Why Invest Your Fintech in Bahrain?

Bahrain, home to the oldest and most established financial center in the Gulf region, has used its extensive banking expertise to grow a modern finTech ecosystem.

Built on years of ongoing stability, the Bahrain investment climate takes a friendly approach to foreign investment. The forward-thinking government permits 100% of foreign ownership of new businesses and allows representative offices and branches of foreign industrial entities, without the need for local sponsors. Likewise, Bahrain also offers a number of business-friendly subsides, including utility-bill coverage and waived fees on industrial land.

The Central Bank of Bahrain (CBB) is continuously reforming policies to promote the funding, quality, and competitiveness of financial sector services. Currently, the CBB is working to introduce crowdfunding regulation, enabling the establishment and growth of equity, debt-based, and Shariah-compliant crowdfunding activities. In fact, the CBB has introduced comprehensive regulations for a wide range of emerging technologies, including open banking, cryptocurrencies, robo advisory, crowdfunding, and sustainable finance, and in February of 2019, the CBB finalized rules for regulating and licensing cryptocurrency asset services, becoming the first to do so in the Middle East.

Additionally, Bahrain’s goodwill towards foreign fintech investment goes beyond progressive laws and political support; in 2017 the CBB launched its regulatory sandbox, a virtual space through which global fintechs can expand into the region. The sandbox is the first of its kind within the GCC, and provides fintech startups with the opportunity to test technology-based solutions within a safe, partially-deregulated environment for up to a year. The Sandbox has already had its first successful graduates. Among them is Rain, the region’s first licensed Sharia-compliant cryptocurrency platform and custodian. Rain graduated in July 2019, and has obtained a full operational license.

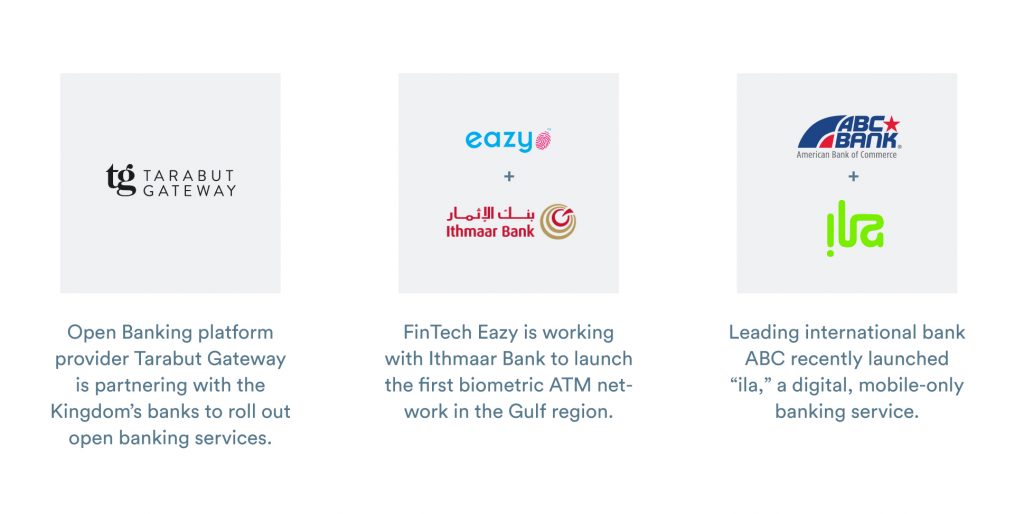

The Central Bank of Bahrain isn’t the only financial institution in the area dedicated to digital transformation; the entire financial sector of Bahrain is pursuing further innovation and transformative solutions, and collaboration with FinTech firms is an obvious path to help drive business forward. The following examples help illustrate this point:

A number of other organisations likewise contribute to ensure that Bahrain’s FinTech ecosystem is one of the most dynamic and competitive in the region. Examples include Bahrain FinTech Bay and Al Waha Fund of Funds. Fintech Bay is the first and largest FinTech hub in the Middle East, and Al Waha Fund of Funds is a USD $100 million venture capital fund providing funding access to Bahrain’s startup industry.

Bahrain’s FinTech ecosystems also encourages a collaborative approach to foreign innovation. This is exemplified in the partnerships between Al Salam Bank and Chinese VC firm MSA Capital. Together, these two key financial players are launching a first-of-its-kind fund established to unify Chinese and Middle Eastern capital and technology markets.

Finally, Bahrain boasts a young, technologically proficient population and a highly connected economy, and an experienced, well-educated workforce provides organisations with the talent to match important jobs. These factors help ensure that fintechs from around the world have everything they need to ideate, test, and implement new approaches to financial services.

Bahrain is already home to a number of influential, disruptive fintech companies, including the following:

Tap Payments

AION Digital

Benefit

BFC Payments

Tarabut Gateway

Eazy

Ila

Fintech and Bahrain: a Bright Future for Financial Services

Fintechs around the world are fundamentally changing and reshaping how customers and businesses approach financial services. Young fintech businesses have a unique opportunity to become an integral part of this revolution, improving the customer financial experience and bringing financial institutions into the new millennium. But to do that, they have to be free to operate in the way that best suits their needs. Bahrain provides a landscape tailor-made to promote fintech success, both in the GCC and around the globe. In Bahrain, foreign fintech businesses can grow to change the world.

Interested in taking advantage of Bahrain’s growing fintech industry? Contact us today, and see just how far you can go.