New regulations released in August 2017 by the Central Bank of Bahrain (CBB) promise to enhance Bahrain’s position as an FinTech powerhouse.

The new regulations, which cover both conventional and Shari’a-compliant investment, enable small and medium-sized businesses in Bahrain and across MENA to raise capital through crowdfunding.

As a means of funding, of course, crowdfunding helps SMEs and start-ups fill gaps in lending and move ahead with developing products and solutions. In Bahrain, we regard it as a vital way both to encourage innovation and support our thriving ecosystem that already comprises more than 60 companies.

Flexible, easy and consistent

This is a prime reason why our ‘flavour’ of crowdfunding makes Bahrain’s solution as flexible as any you would find in the UK, Singapore, Dubai or Malaysia.

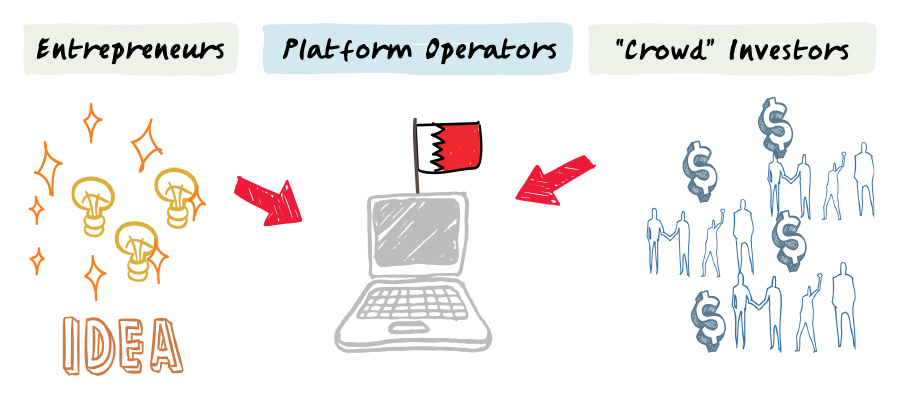

For example, both local and global SMEs can raise funds; standardised declaration forms make reporting easy and consistent; and platform operators (companies that bring entrepreneur borrowers and ‘crowd’ lenders together) may – subject to additional licensing – offer lending or equity-based investment.

And, while the conventional and Shari’a-compliant regulations are broadly the same, Bahrain is the first GCC country to have issued stand-alone Shari’a-compliant directives, providing reassurance of lending in accordance with Shari’a rules.

Regulatory quality is key

So, why is Bahrain’s crowdfunding offering so convincing? Primarily, it’s down to the quality of our single integrated regulator.

The CBB is recognised as an advanced financial supervisor with a proven record for creating clear, accessible regulations for business that promote integrity, accountability and transparency, while providing the highest levels of protection for investors, entrepreneurs and fundraisers.

But as well as being robust and rigorous, it is inventive: recently the CBB introduced MENA’s only onshore Regulatory Sandbox, which has already attracted its first two entrants – Tramonex, a London-based forex cash management solution, and NOW Money, a Dubai-based account and remittance service. A virtual space for entrepreneurs to safely test FinTech technology, it also ensures that products and businesses who want to operate in Bahrain are sound.

Three further factors make Bahrain compelling for crowdfunding. In parallel with unrivalled 40-plus years’ experience as a regional financial services centre, we are also a global leader in Islamic finance, with the region’s highest concentration of funds and institutions, and a strong reputation for raising funds. What is more, businesses can operate in a cost-competitive environment: it’s around 30% cheaper to run a financial services firm here than in Dubai or Qatar.

Commenting on the new regulations, Mr. Khalid Hamad, Executive Director at the CBB, said: “We expect Bahraini entrepreneurs to benefit from the global crowdfunding trend, which provides a viable alternative to bank financing. In particular, the CBB is keen to see Bahrain dominate the Shari’a compliant financing-based crowdfunding market in the region. The demand for Shari’a compliant financing is already high and we expect to see it reflected in the crowdfunding market as well.”

Bahrain’s crowdfunding model