If you’re looking to start or move your business abroad, Bahrain has created an environment for businesses to be more profitable so your business can thrive. Between the forward thinking government and an agile business environment, there are many perks to establishing your company here in Bahrain such as:

- 0% corporate tax rate

- No personal income taxes

- No wealth or capital gains taxes

- Some of the lowest operating costs in the GCC

- Flexible foreign ownership laws

Keep reading to learn more about these benefits and see why Bahrain might just be the best place for your next business venture.

0% Corporate Tax Rate and No Income Taxes

The government of Bahrain doesn’t collect corporate taxes on businesses that do not work in the oil and gas industry. Which gives you plenty of business opportunities that can be owned and operated without ever having to pay taxes on your business. Additionally, there are no wealth or capital gains taxes in Bahrain. When you no longer have to pay any of these taxes, you’re able to keep more of your business’ profits or invest more back into your business.

Your employees can keep more of their paycheck too thanks to Income taxes not being charged in Bahrain either. Even if your company has forgien workers, your employees won’t have to pay income taxes as long as they obtain a residency permit from you as their employer.

Low and Competitive Operating Costs

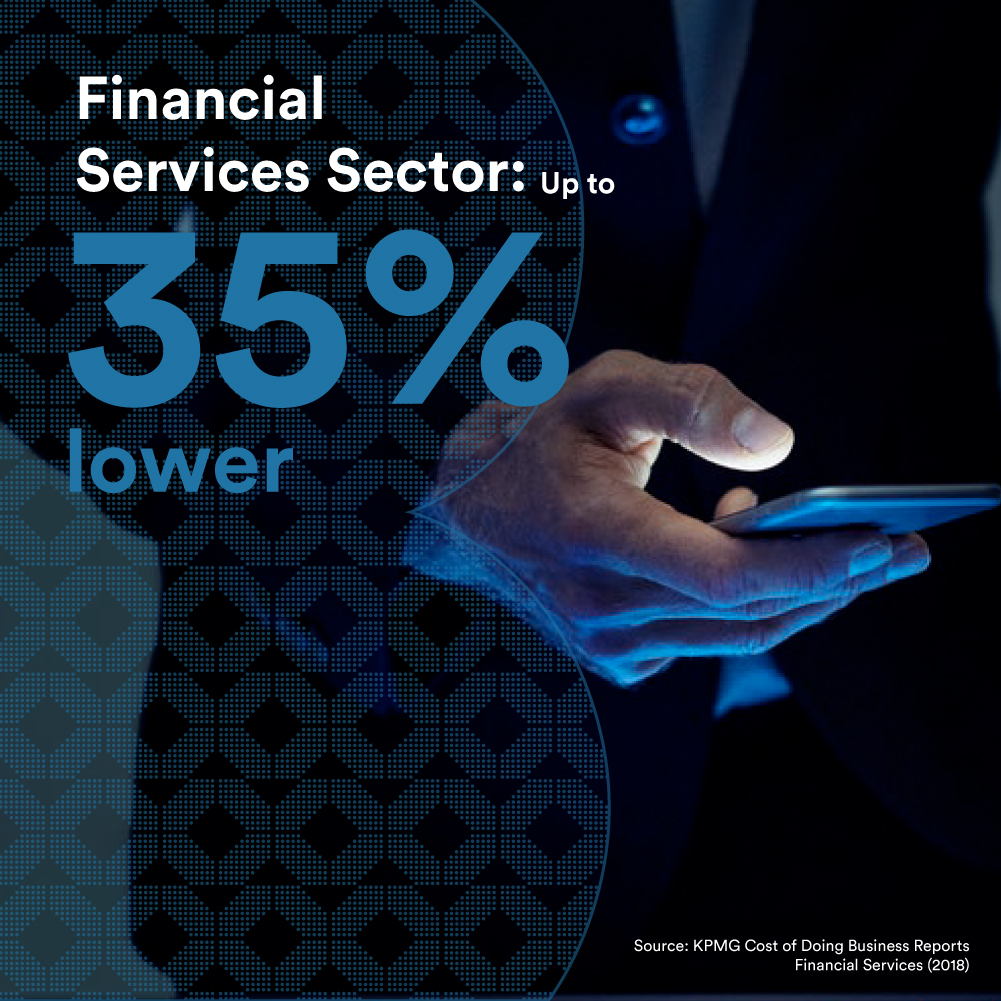

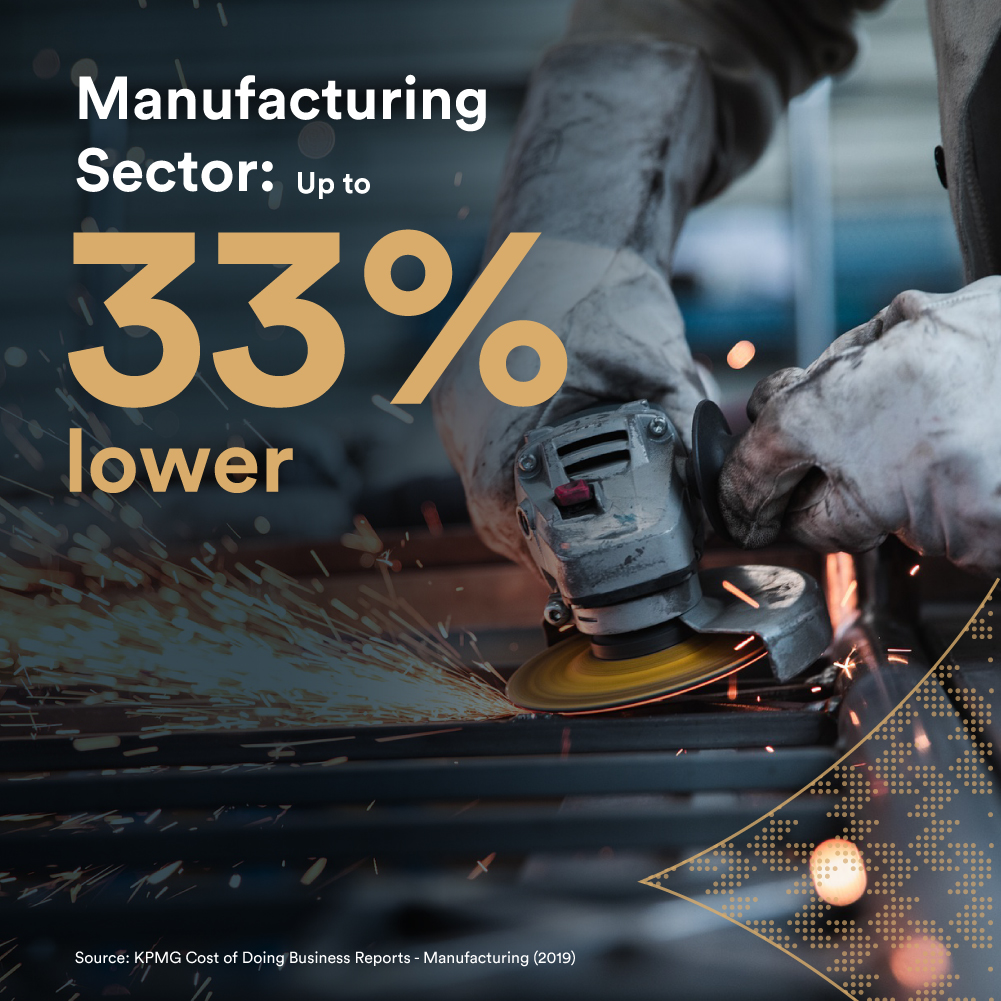

Bahrain offers some of the lowest operating costs in the GCC for all types of businesses. When you’re paying lower costs, you’ll be able to produce more goods or provide more services for less, giving you higher profit margins and more room for growth as a company.

Not only does Bahrain offer low costs, but it has the stats to prove it.

Foreign Ownership Laws

Bahrain is a free trade zone which allows goods to be traded freely to, out of, and through Bahrain with little to no customs duties. Additionally, Bahrain has flexible foreign ownership laws that give you the opportunity to operate a business in one of the following sectors without being a citizen of Bahrain:

Real Estate

Healthcare and Social Work

Information and Communications

Manufacturing

Food, Arts, Entertainment, and Leisure

By taking advantage of our foreign ownership laws you’re able to experience all of the benefits of running a business in Bahrain while maintaining your citizenship in your home country.

Ready to Take the Next Step?

If you’re ready to start taking advantage of all these benefits, it’s time to talk to Bahrain EDB. We’re able to help you through every step of the way including:

- Finding a location for your business

- Legal requirements

- Help in establishing beneficial connections

- Specific market opportunity advisory

- And more!

Contact us to learn more about everything that Bahrain has to offer and to get started on establishing your business in Bahrain.